Blast Vision

Read this post to understand the future of Blast. To understand the past, check out Blast's first quarterly report.

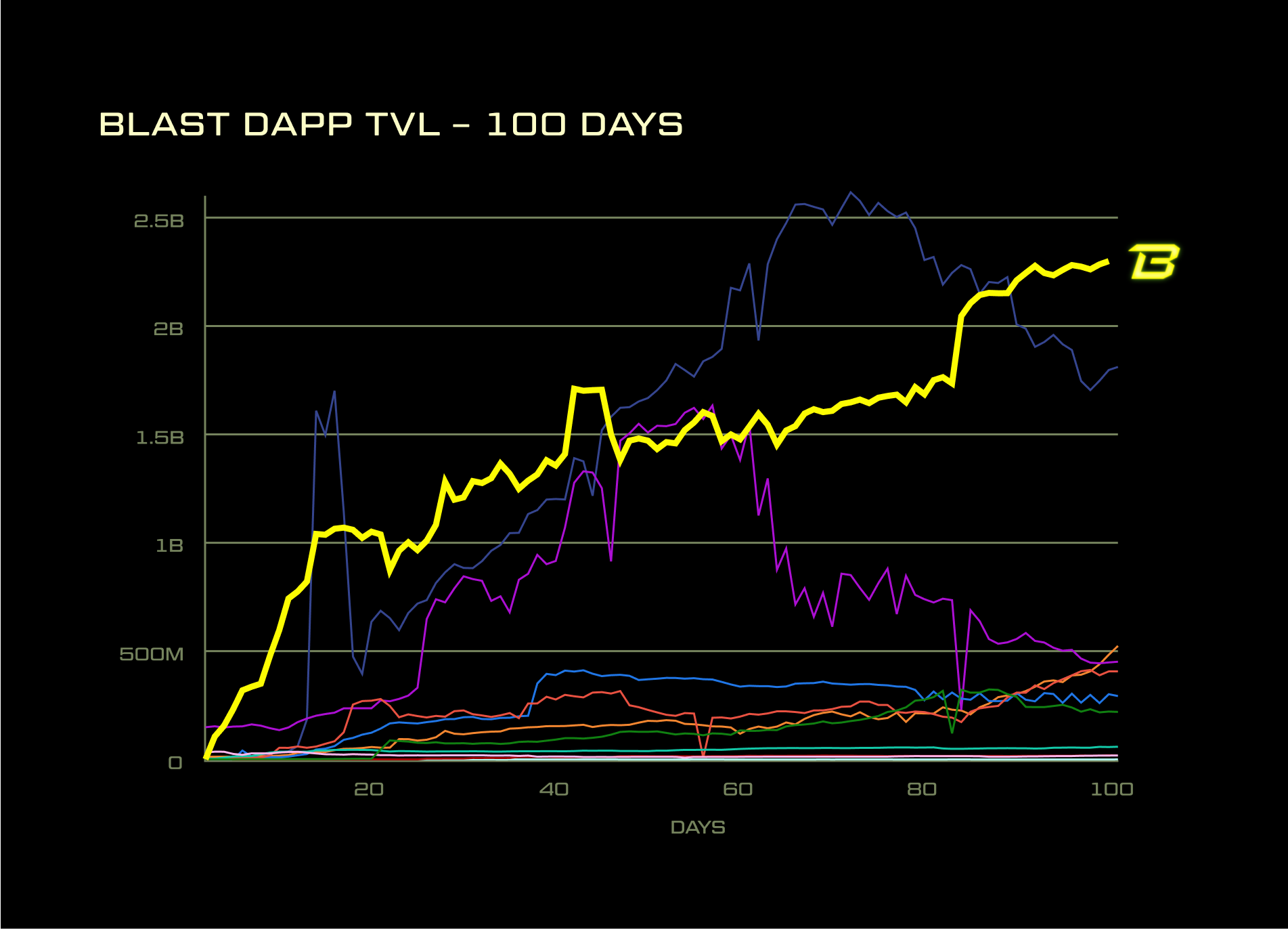

As you know, Blast started as the chain with native yield. In 4 months Blast has grown to the 6th largest onchain economy, and is one of the fastest growing chains of all time.

The big question now is, what’s next? Blast’s overarching purpose is to accelerate the market’s transition from an offchain economy to an onchain economy. To understand how to do that, let’s first take a look at the present state of the world.

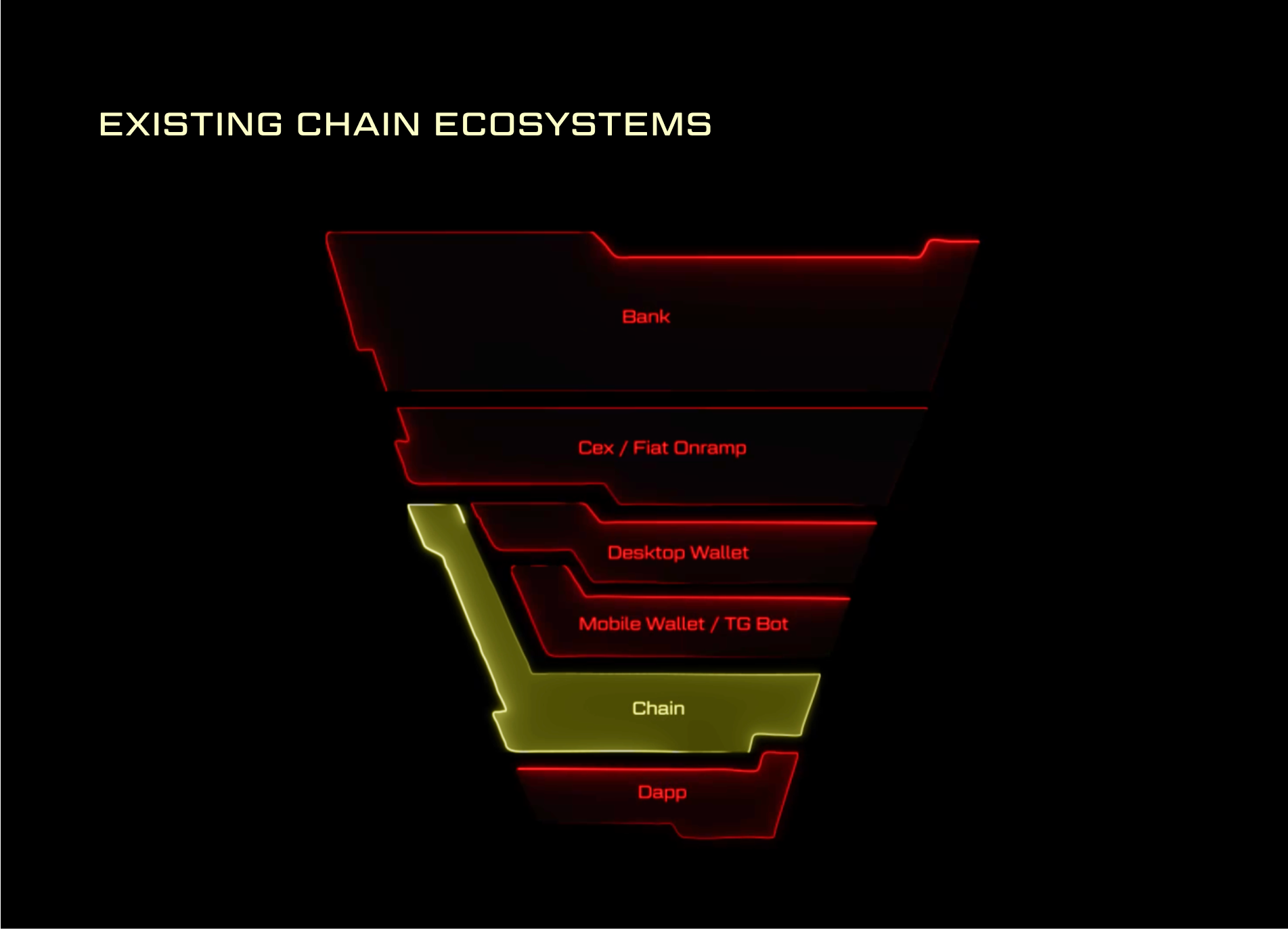

If you look at existing chains today, you’ll notice they all have a similar end-to-end user experience. Each chain focuses on optimizing the chain itself, while relying on third parties for the rest of the stack. This approach is effectively the Android approach, where they optimize the operating system, and rely on third parties for the rest. The Android approach has worked for chains so far, but it has resulted in an ecosystem that is fragmented and filled with friction.

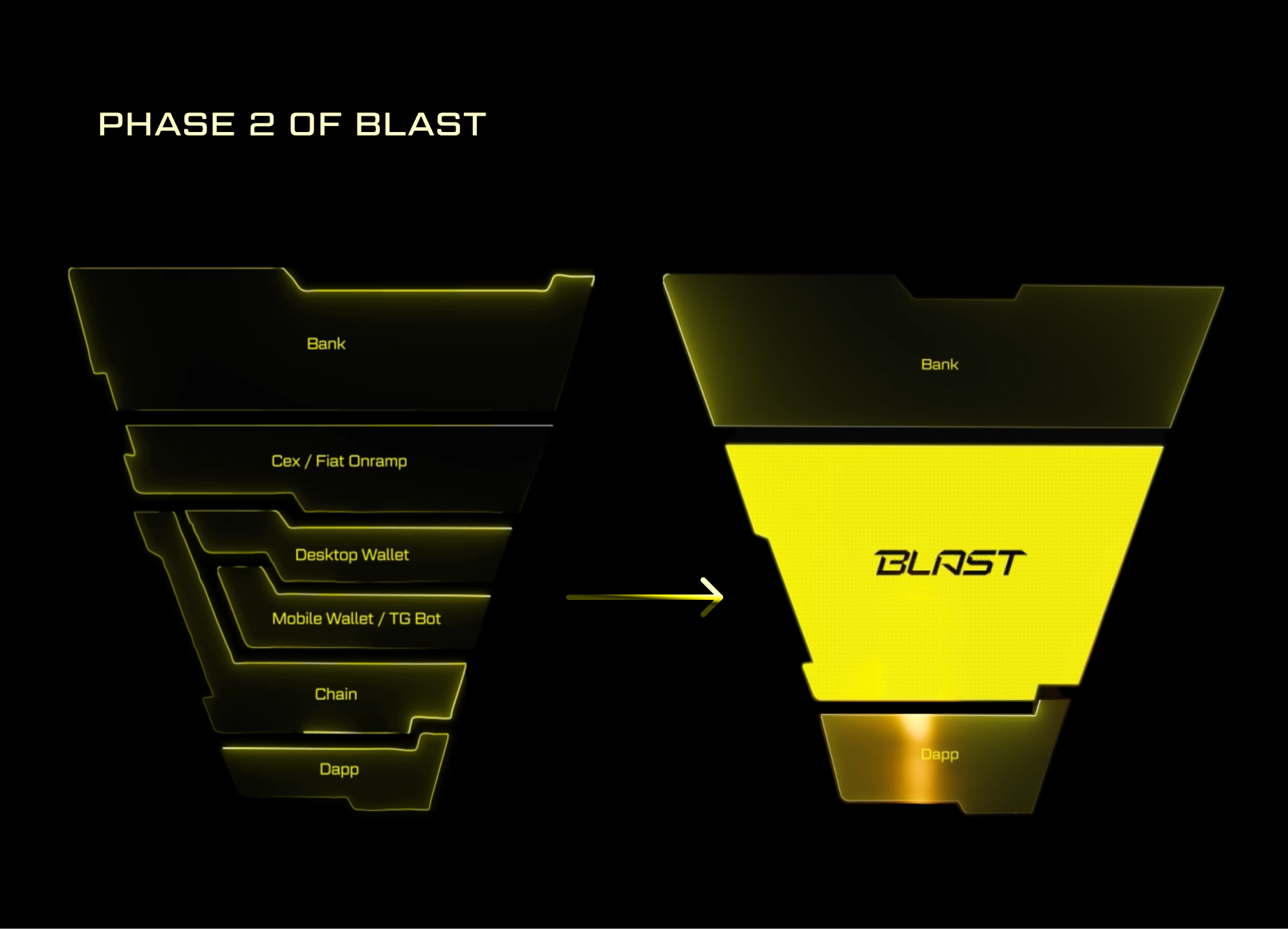

Unlike Android, Apple takes a fullstack approach. They build everything from the software to the hardware and optimize across the full stack. This approach drastically accelerated the transition to mobile and resulted in the most valuable mobile ecosystem in the world.

The focus of the next phase of Blast, Phase 2, is to create the fullstack chain.

Without giving away too much, in Phase 2 the Blast Foundation will work with the community to create a desktop and mobile wallet, specifically for cryptonatives. There is a clear opportunity to build an experience significantly better than Metamask, and we will leverage incentives to accelerate adoption, but that’s just the beginning.

Now it’s important to address two repeated arguments against Blast — incentives and the degen focus.

Criticism 1: Blast incentives only bring fake activity, not real users!

Incentives get a bad rep because they are often applied poorly and can mask a lack of product market fit. But incentives are incredibly effective if used correctly. People forget that the crypto economy grew from zero to a trillion dollar market with the power of incentives introduced in the Bitcoin Whitepaper.

Incentives are the most effective tool for developing new ecosystems. Before Bitcoin, the Homestead Act of 1862 incentivized development of the American West. This drove significant expansion and immigration to western states (approximately 10% of all land in the US was developed through the Homestead Act).

Blast’s incentives are extremely targeted. The vast majority of Blast’s Phase 1 incentives were allocated to dapp categories that already had strong product market fit like dexes, perp dexes, and lending protocols. These are categories that have proven to be retentive.

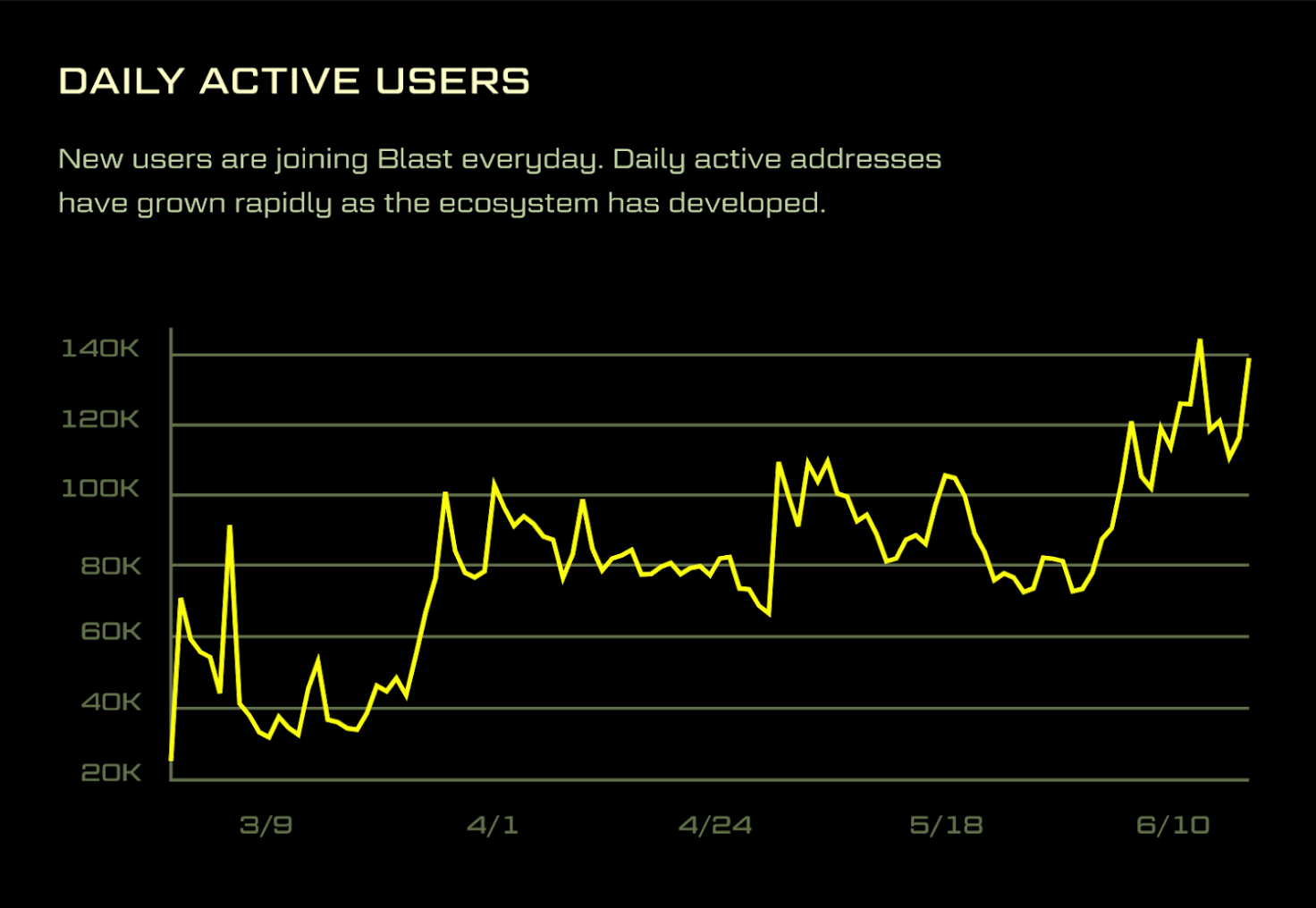

If you look at Blast’s metrics, you’ll notice both user and transaction growth have been up and to the right since launch. The incentives didn’t change throughout Phase 1 — they were applied consistently throughout. As more dapps came to market and the ecosystem developed, Blast experienced an inflection in growth.

The change in qualitative user feedback as the season progressed further validates this development.

Criticism 2: Blast is just a degen chain!

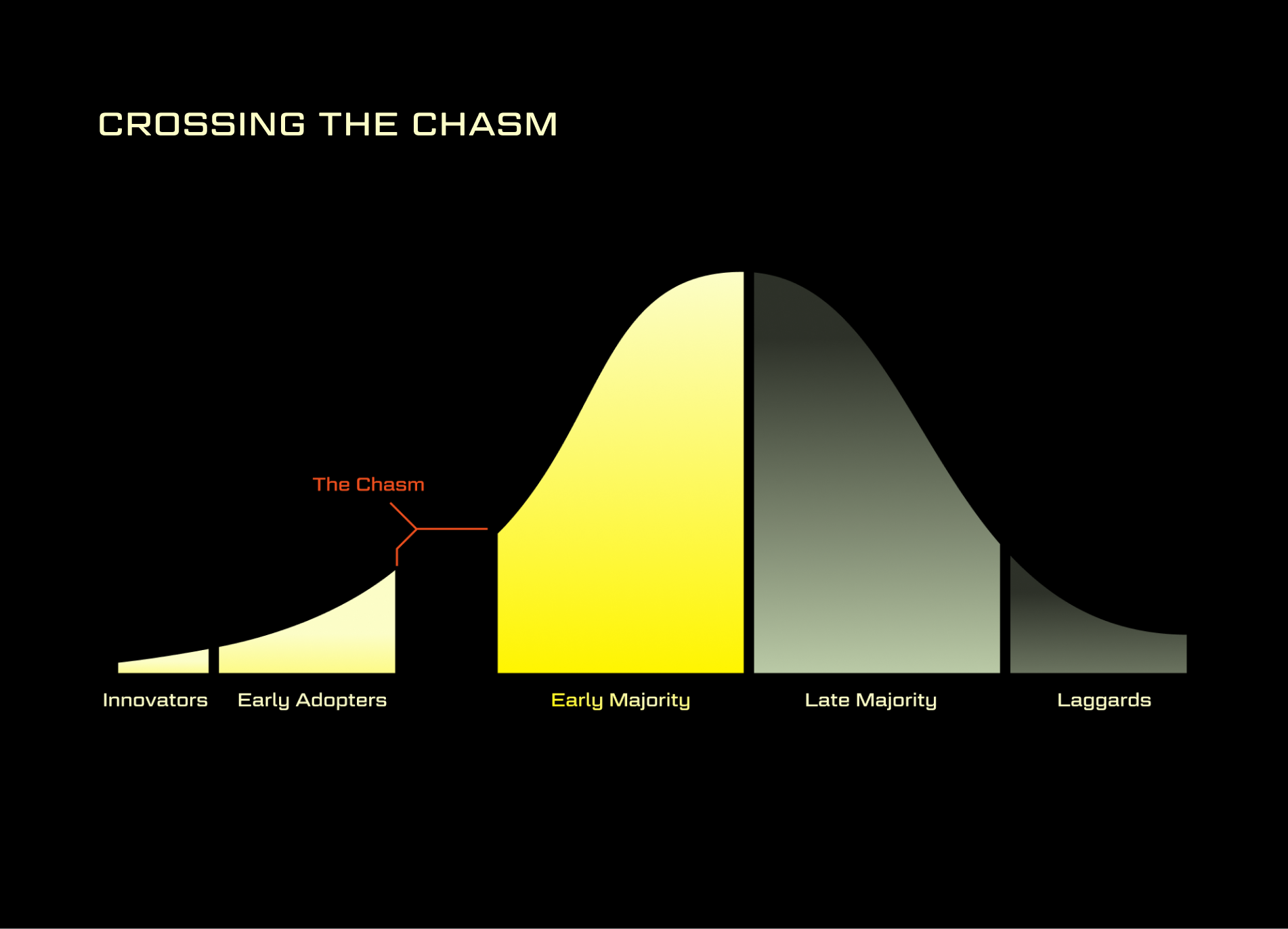

A common criticism of Blast is that it is a degen chain. Being a “degen chain” wasn’t an accident. It was the focus all along. If you study the history of crypto, you’ll notice the recurring trend of cryptonative solutions winning. Every technology has a similar adoption cycle. At the start, only early adopters are interested. And it’s not until practical value and utility are proven out that the early majority and late majority start to take notice. Growing past the small base of early adopters to the early majority is known as crossing “the chasm.”

For technologies like chains that require a network effect to take value, this chasm is incredibly difficult to breach. Going after the “early majority” before you have built up sufficient infrastructure and network effects is a recipe for failure. Degens are the early adopters of the onchain economy. Blast hyperfocused on them to build up a beachhead network of early adopters. We will continue to focus community efforts on early adopters until the full stack has been developed, at which point we can focus on crossing the chasm.

Crossing the chasm

After building the fullstack chain, crossing the chasm will require a significant, community-wide effort. Blast is uniquely positioned to accomplish this. Native yield provides single player value that is intuitive to all. Native yield opens the door for new business models that aren't possible elsewhere. And while the currency of choice for onchain adopters today is ETH, the currency of choice for the rest of the world is USD. Blast's yield-bearing USDB provides a unique advantage in onboarding the rest of the world. USDB is already the 5th most traded stablecoin globally, all from onchain dex activity.

If we succeed in crossing the chasm and accelerating the transition onchain, what does that future look like? The most native onchain users today already reveal the answer. They spend over 90% of their time onchain, and have over 90% of their net worth onchain. As an onchain native, they can earn yield just by holding funds in their wallet. They can send funds to anyone, anywhere, anytime, at near-zero cost. They don’t need a bank, savings account, Paypal, Stripe, Visa, or Mastercard. They are effectively unbanked. If Blast succeeds, the end result won’t just be that we will have banked the unbanked. The end result is that we will have unbanked the banked. Blast’s mission is to accelerate that future, to unbank the banked.

If you want to join us, you can bridge and start earning Native Yield + BLAST in Phase 2.